As we hear more and more about the nation’s vast infrastructure needs, the Highway Trust Fund‘s impending bankruptcy and MAP-21’s looming expiration, you’d be forgiven for thinking that we’re facing a national “transpo-mageddon.” Adding to this view is the Pew Charitable Trusts’ new analysis, “Funding Challenges in Transportation Infrastructure,” which takes a close look at national, state and local funding for transportation projects. The report, released on May 5, paints a stark picture of the current nationwide transportation funding crisis, with three particularly salient points for the region and nationwide:

1) States rely on a combination of funding sources for transportation projects. According to Pew’s analysis, the federal share of state highway and transit funding for New York and New Jersey is less than 25 percent; the federal share for Connecticut is 30-34.9 percent. Though considerably less explicit than T4’s recent findings, the point remains the same: all states depend on the federal government to help pay for transportation projects.

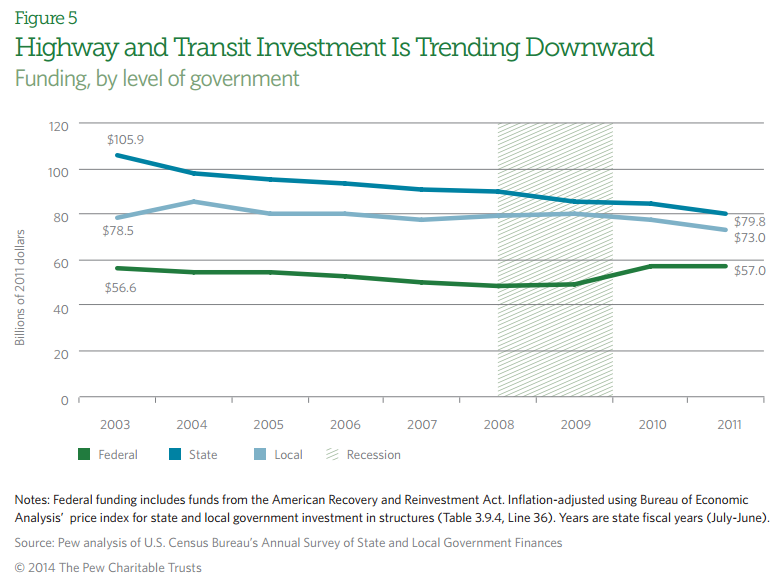

2) State and local governments are spending less money on highway and transit projects. Although the Pew report doesn’t provide an analysis for each individual state, it does show that from 2003 to 2011, state investment on highway and transportation projects decreased by 25 percent. In 2003, states spent $105.9 billion (in 2011 dollars); in 2011, this dropped to $79.8 billion. Local funding also dropped, from $78.5 billion in 2003 to $73 billion in 2011. Federal funding increased only slightly during this period, from $56.6 to 57 billion.

3) Highway revenue at both the federal and state level is overwhelmingly dependent on gas taxes, vehicle taxes and tolls—but gas tax revenue has fallen at both the federal and state level. Pew’s analysis, shows that fuel taxes, vehicle taxes and tolls make up 72 percent of federal highway revenue and 60 percent of state-level highway revenue. In stark contrast to the high dependency on this revenue source, the report finds that federal and state gas tax revenue decreased in the period 2002 to 2012. As if shrinking gas tax receipts due to “changing driving habits and increased fuel efficiency” aren’t enough, the analysis notes that “federal and many state gas taxes remain a fixed amount per gallon, even as transportation construction costs increase. This means that the revenue generated by each gallon of gas doesn’t go as far as it did in the past in paying for transportation needs.”

Pew’s analysis underscores a need for a robust federal transportation bill with a sustainable funding source behind it. It also makes clear that similar issues exist at the state level and likewise, must be addressed. While President Obama and the Senate Environment & Public Works Committee have released reauthorization bills (the House’s is excepted in early summer), it remains to be seen whether the final legislation will truly identify the necessary funding mechanisms to address the nation’s critical transportation needs.

[…] federal gas tax following its release of a poll that found that 67 percent of Americans support a gas tax increase to fund federal infrastructure […]