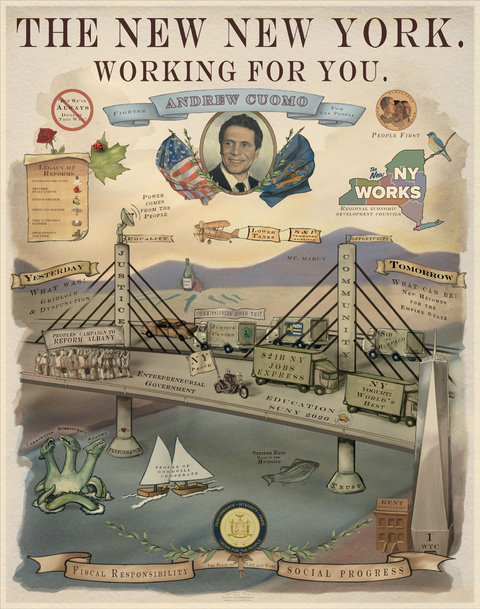

Governor Cuomo will give his State of the State address on January 9, providing the first peek at his 2013-2014 Executive Budget. In case he’s looking for suggestions, Tri-State Transportation Campaign has developed a wish list that will help move New York towards a more sustainable transportation future.

A dedicated budget line to fund bicycle and pedestrian infrastructure

Communities across the state are eager to provide citizens of all ages and abilities with safe, healthy and low-cost active transportation options. Now, post-Sandy, there is a heightened awareness of the importance of bicycle and pedestrian infrastructure. Safe cycling infrastructure helped keep New York City’s economy moving in the aftermath of Sandy, with NYCDOT reporting a 150 percent increase in cycling over the East River Bridges in the days after the storm. Unfortunately, at the same time that demand is expanding, the pot of money for bicycle and pedestrian infrastructure is shrinking. The new federal transportation law, MAP-21, has reduced dedicated funding for this type of infrastructure by 30 percent, and the state spends only 2 percent of its capital program to support safe cycling and walking.

A Speed Camera Demonstration Program for NYC A7737/S7481

New York has a pervasive speeding problem, and speeding kills. If a driver strikes a pedestrian at 40 mph, there is a 70 percent chance that a child will be killed; at 30 mph (NYC’s speed limit) they’ve got an 80 percent chance of surviving. Speeding not only costs lives; it costs money too. In 2009, the National Highway Traffic Safety Administration estimated that the economic cost of speed-related crashes in the US is $40.4 billion each year—that’s $76,865 per minute.

Under the Bloomberg administration, NYC Department of Transportation has embarked on significant initiatives to reduce speeding in the City, including Neighborhood Slow Zones, traffic calming projects and an ad campaign highlighting the importance of obeying the 30 mph speed limit. But the city needs more tools. Research shows that speed enforcement cameras reduce injuries and fatalities by 40-45 percent, and reduce speeding by 71 percent.[1]

Transit Commuter Benefits S2728-C/ A 6175-B

Today, an estimated 15,000 employers with more than half a million employees in New York State offer tax-free commuter benefits to their employees. Because New York State has chosen to have its tax code mirror federal tax provisions in this regard, New York workers taking advantage of pre-tax commuter benefits receive savings in terms of not only federal, but also state income taxes. Employers save as well through the reduction of taxes on their payrolls.

Unfortunately, on December 31, 2011, as a result of Congress’ failure to act, New York’s transit commuters got hit with a tax hike. This year, a commuter earning $50,000 a year and spending $230 per month on transit will pay more than $400 extra. This bill, championed by Senator Charles Fuschillo, will permanently restore the commuter’s pre-tax deduction benefit on their state taxes, whether or not Congress acts in the future.

MTA Funding and a Permanent, Statewide Redistribution of the Long Lines Tax

It will also be crucial that the Governor protect dedicated funding for the MTA. This would include making sure the budget does not sweep any of the dedicated funds for transit and that the Governor keep his promise to make the MTA whole for the funds lost in the partial repeal of the Payroll Mobility Tax. Running a transit system requires steady and predictable sources of revenue each year. Transit providers need to plan ahead and take a long-term look at their systems and service. While the MTA has a variety of dedicated revenue sources (although inadequate and volatile), non-MTA systems only have one dedicated source: State Transit Operating Assistance, known as “STOA” funding.

Last year, the NYS legislature provided a second source for non-MTA transit systems: the Long Lines Tax, which is a tax that is collected statewide, but has historically flowed into the downstate MTA account. On average, this redistribution gave Long Island, the Hudson Valley and upstate bus and rail systems a much-needed boost in their operating funds, and helped to stem some troubling service cuts, particularly in Buffalo, and prevented deeper cuts in Nassau County. The state needs to permanently redistribute this tax statewide, in order to assure that these systems can better predict their funding futures.

[1] Wilson, C., Willis, C., Hendrikz, J.K., Bellamy, N. “Speed Enforcement Detection Devices for Preventing Road Traffic Injuries,” The Cochrane Collaboration (2006).

Another thing that transit lovers need from the Governor and State Legislature is an increase in state funding to support Amtrak service in the Empire Corridor. Under federal law NYS must began sharing in the cost of existing trains to Albany, Buffalo and Niagara Falls (other than the Maple Leaf and the Lake Shore Limited). The state already funds the deficit on the Adirondack. With more state support should come greater state say on fares and schedules.