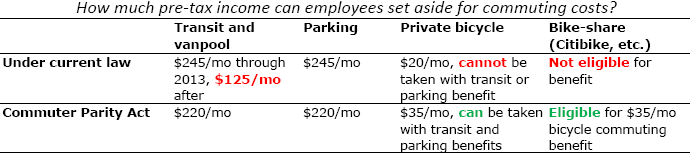

For the last three years, train and bus riders have had to deal with annual uncertainty over the fate of the commuter benefit for public transit. The latest band-aid for the transit benefit extended it at its current level of $245/month through the end of 2013. Without action from Congress, however, the transit benefit will fall to $125/month next year, costing commuters in the tri-state area hundreds or even thousands of dollars. The parking benefit would remain $245/month, meaning the tax code would, perversely, provide nearly twice the incentive for driving.

Now a bipartisan group of Congressmembers is pushing to set the transit and parking benefits permanently equal to each other, while also reforming a portion of the tax code (HR 2288). The Commuter Parity Act, introduced by U.S. Representative Michael Grimm (R-New York), who represents Staten Island and Brooklyn, and co-sponsored by Peter King (R-New York), as well as Earl Blumenauer (D-Oregon) and Jim McGovern (D-Massachusetts), would provide fixes for this inequity: it reduces the transit and parking benefit to $220/month. In addition, this reduction in the total benefit for both motorists and transit users would be revenue-neutral, potentially making passage a little more likely.

“Without transit parity, we continue to create an incentive to drive and put an unfair financial burden on New York City’s hard-working families and residents who rely daily on public transportation,” Rep. Grimm said at a rally in Washington. “It is only fair that the pre-tax benefit be made permanently equal, no matter how one commutes to work.”

Another oddity in the federal tax code concerns the $20/month benefit for bicycle commuting costs. Currently, the benefit cannot be combined with other commuting benefits. For example, someone who bikes to a rail station and takes the train to work is forced to choose between the transit and the bicycle benefit. The new bill language would close this loophole, as well as allow for the bicycle benefit to be applied to bike share systems like New York City’s Citi Bike. This would help not only bicycle commuters, but also the many transit commuters who also use bike share, of which there are many. Citi Bike stations outside Penn Station and Grand Central Terminal are among the busiest in the system.

As of today, the bill has 32 co-sponsors. Co-sponsors from the tri-state area include Reps. Joe Crowley, Rosa DeLauro, and Elizabeth Esty of Connecticut; Steve Israel, Sean Patrick Maloney, and Jerrold Nadler of New York; and Albio Sires of New Jersey.

How can readers support this coalition?

[…] Allowing the pre-tax benefit for transit to fall back to $125 — roughly half of what drivers are allowed — is unfair, and essentially provides an incentive to drive. […]