Today’s post, the third in a week-long series on land value capture, will focus on how real estate activity impacts the MTA through “transfer taxes.” Although transfer tax revenues are not traditionally considered a value capture strategy, it highlights the effects of LVC tools: increased development activity boosting revenues for transit. Today’s post also explores how communities can try to offset the gentrification and displacement from increased land values.

The monetary benefits of LVC strategies discussed in this week’s blog posts become amplified when transit operators have a stake in the local real estate market, as is the case for the MTA. The agency receives funding from portions of the city’s real property transfer tax (RPTT) and mortgage recording tax (MRT), which are referred to collectively as “transfer taxes.” As a result, when LVC strategies are successful, and property values increase, the MTA receives a secondary benefit via increased transfer taxes in addition to any direct investment in transit through the private sector via LVC.

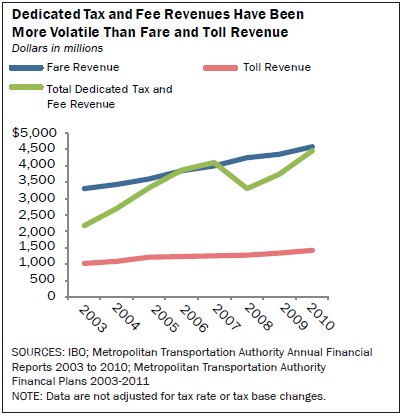

The transfer tax can have significant impacts on funding for the MTA based on real estate market conditions. These impacts were pronounced during recent years, where wild fluctuations in the region’s housing market exacerbated funding challenges for the MTA:

- 2007: Revenues from city and state transfer taxes peaked at $1.6 billion, accounting for around 38 percent of the MTA’s total revenue from tax-supported subsidies.

- 2008: As the housing market took a hit, transfer tax revenues fell to 26 percent ($855 million in revenues).

- 2009: Transfer tax revenue continued to fall by over half compared to the previous year, accounting for just over 10 percent ($389 million in revenues).

- 2010: Because other dedicated tax revenues grew, transfer tax revenue recovered slightly to $413 million, but transfer taxes as a share of total tax supported subsidies fell just below 10 percent.

Development activity spurred by LVC tools like TIFs and SADs can boost revenues for transit systems that receive transfer taxes, and can generate significant funding when real estate is booming. A positive effect of such a boom for local transit riders was seen in 2007, when high tax revenues allowed the MTA to abandon plans for a fare hike.

LVC’s Equity Challenges

Increased property values aren’t necessarily always a good thing. Development around transit stations in low-income neighborhoods often spark a rapid rise in land and housing costs, which often leads to gentrification. In order to avoid displacing existing residents, municipalities can establish measures like inclusionary zoning, community land trusts and community benefits agreements.

When a LVC strategy such as tax increment financing (TIF) is used, it is crucial that municipalities ensure that a share of TIF revenue is set aside for affordable housing. Both Utah and California, for example, have mandated that 20 percent of TIF funds go toward affordable housing within TIF boundaries. The city of Portland, Oregon, having learned from their mistakes, adopted a policy to dedicate 30 percent of TIF funds to affordable housing.

There are other ways to ensure that existing residents benefit from economic development and revitalization that can occur through better transit investment . The Town of Babylon on Long Island established a Community Development Program (CDP), which offers programs to assist current and prospective low and moderate income homeowners with home financing and rehabilitation needs. Building equity for existing residents through programs like CDP’s Wyandanch Rising Down Payment Assistance Program (which aims at providing financial assistance to income eligible first-time homebuyers) is critical, especially as the Wyandanch Rising transit-oriented redevelopment (TOR) project begins to transform one of Long Island’s most economically distressed neighborhoods.

Tomorrow’s post will focus on examples of land value capture from around the country.

Excellent article. There are two primary reasons that land values rise near transit. First, a community is providing a service that many people value and want to use. Second, land speculators believe that this resource will become more valuable in the future, so they buy land because they hope to make a windfall off of future land value increases.

It is rather strange that the public ends up paying for infrastructure twice. First, they pay taxes to create transit. Then they must pay higher rents to get access to the transit services that they have already paid for.

Value capture techniques that assess a fee against publicly-created land values can help remedy this situation. Unlike fees or taxes on buildings (which make them more expensive), fees or taxes on land values make land more affordable. The reason for the difference is that buildings are produced — so a tax or fee on buildings is a cost of production. Land, is NOT produced. There will be just as much land after higher fees or taxes are imposed as there was before. So the fee on land values is a cost of ownership. By making ownership more costly (and thereby reducing the profits from land speculation), land speculation becomes less attractive and the demand for land from speculators can be reduced.

Revenues from publicly-created land values can help make infrastructure financially self-supporting (to a greater degree than today), thereby helping keep general taxes low. And, by reducing land price inflation, value capture can help residents and businesses get access to high-value locations for a more reasonable cost.

Of course, some residents will need subsidies, but limited subsidy funds will help more people when the underlying market price of land is kept in check.

So, for all these reasons, value capture can help make residential and business locations near transit more affordable.

For more info, see “Using Value Capture to Finance Infrastructure and Encourage Compact Development” at https://www.mwcog.org/uploads/committee-documents/k15fVl1f20080424150651.pdf