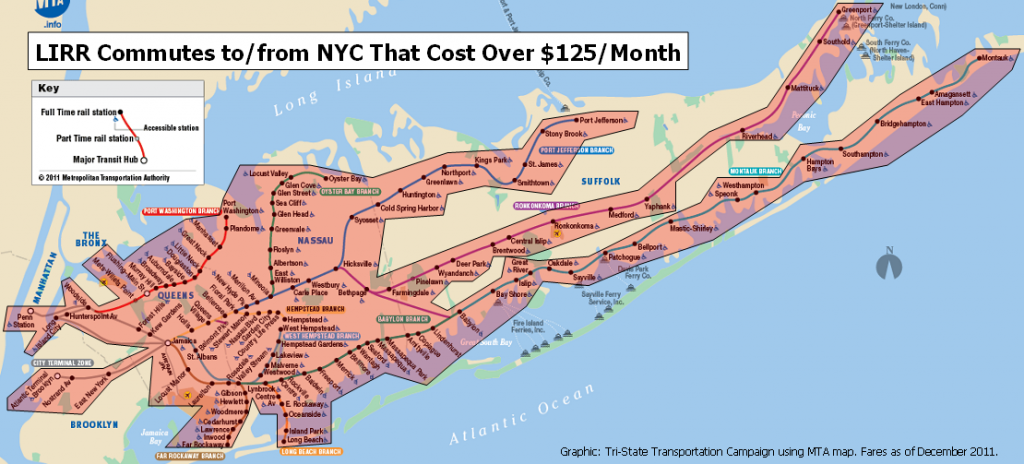

The just-passed deal to avert the “fiscal cliff” contains an important provision that will provide hundreds of dollars in tax relief for many transit riders in the region. That’s because the deal restores equality between the federal commuting tax benefits for parking and for public transit. Commuters can now use up to $240 a month in pre-tax dollars toward the cost of rail, bus and vanpooling. In 2012, Congress’s failure to renew this provision meant that the maximum monthly benefit for transit was $125, even though commuters could use up to $240 each month for parking.

The fix is retroactive for 2012 (the IRS has yet to say how commuters can claim this deduction) and will last until the end of 2013. Based on calculations done by TransitCenter, a benefit provider, this represents a tax cut of over $400 for an individual who makes $50,000 annually and spends at least $240 monthly on transit.

In a statement, Tri-State thanked “transit champions” in Congress, including Sen. Chuck Schumer (D-NY), who has been the highest-profile advocate for the provision, and Rep. Jim McGovern (D-MA) as well as other key tri-state area members such as Senators Frank Lautenberg and Robert Menendez (both D-NJ) and Reps. Peter King and Michael Grimm (both R-NY).

The transit benefit was one of several tax provisions that was extended by the deal, including a railroad maintenance provision which has been credited for keeping much of the nation’s “short line” railroads connected to the national freight network.

The deal also delays until March the so-called “sequester,” which would impose automatic budget cuts of roughly 10% on most government programs. Though most transportation programs appear exempt from sequestration, cuts would impact transit capital projects and Amtrak, as well as other sustainable transportation programs like USDOT’s TIGER program.

[…] a permanent fix didn’t make it into MAP-21. But the transit benefit was extended as part of the fiscal cliff deal passed at the beginning of 2013. The provision offers economic relief for transit riders and […]

[…] this automatic cut of $85 billion across most federal agencies was left on the back burner in the deal to avert the “fiscal cliff” earlier this year, which contained several tax provisions including transit benefits and a […]

[…] transit and vanpool riders can take up to $245/month in a pre-tax deduction to cover their commute expenses. The commuter tax benefit is a retroactive fix for 2012 (when the transit tax benefit was lessened […]

[…] three years, train and bus riders have had to deal with annual uncertainty over the fate of the commuter benefit for public transit. The latest band-aid for the transit benefit extended it at its current level […]

[…] deal made last January to avert the “fiscal cliff” included a provision that eventually brought the monthly transit commuter benefit up from $125 to $245 to match the […]

[…] parity with motorists – The deal made last January to avert the “fiscal cliff” included a provision that temporarily matched the pre-tax transit benefit with the parking benefit. This was a big win […]