Tuesday may have been the Twelfth Day of Christmas, but the gifts will keep on coming for New York State Thruway drivers. On Wednesday, Governor Cuomo announced a tax credit plan that would halve tolls for passenger, business and commercial drivers on the Thruway. Average annual savings would amount to $97, $686 and $1,872, respectively.

These tax credits–not deductions, but rather dollar-for-dollar reductions on a driver’s state tax bill–are pricy gifts from New York State taxpayers to Thruway drivers. But between last year’s $1.285 billion state commitment and this year’s additional $700 million state subsidy for Thruway infrastructure, state taxpayers should not be asked to further subsidize Thruway drivers. Here’s why:

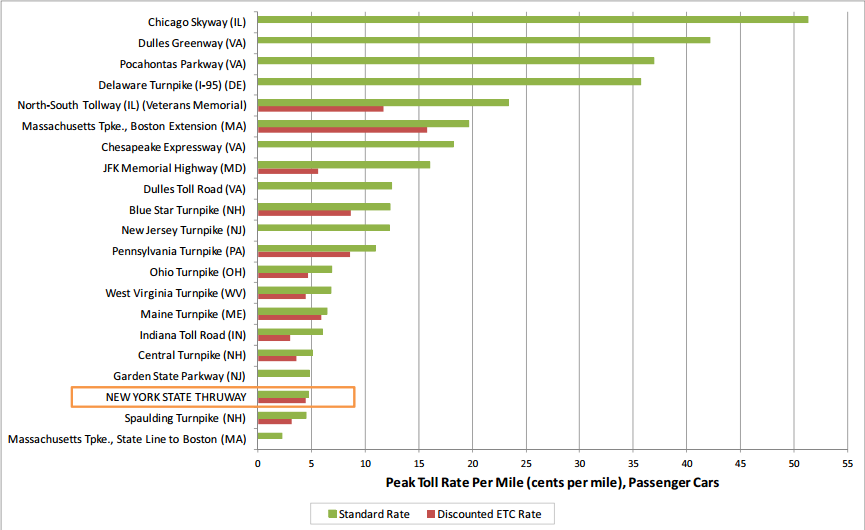

Thruway commuters already pay low tolls. Existing Thruway tolls are significantly cheaper compared to what drivers pay on other tolled roadways. What’s more, those commuters already receive a 35 percent subsidy in costs compared to usage.

MTA transit systems serve 10 times the number of Thruway users. MTA transit systems–LIRR, Metro-North and NYC Transit Subway and Bus–collectively provide 2.588 billion rides every year. Meanwhile, roughly 250 million vehicles use the Thruway each year. New Yorkers residing in the MTA service region represent 60 percent of the state population, yet pay billions more in taxes than they get back. If taxpayers are being asked to invest in transportation, then that money would be better used to fund the state’s $8.3 billion commitment to the MTA Capital Plan–the source of which remains unidentified.

Lower tolls undermines GHG reduction targets. Reducing tolls encourages more driving, which leads to increased greenhouse gas emissions. Last fall, Governor Cuomo announced a state commitment to reduce emissions by 80 percent by 2050–and transportation is the largest contributor of New York’s GHG emissions.

Thruway commuters and businesses already benefit from the current toll structure. In Rockland County, drivers who take the Thruway pay 30 to 80 percent less in commuting costs than those who ride transit. And while an 18-wheel truck causes the same amount of damage as 9,600 passenger vehicles, truck toll rates pay just five times the rate a passenger vehicle does on the Thruway.

We have invested so much in driving, and what do we have to show for it? Air pollution, traffic congestion, diseases associated with sedentary lifestyles, cities and towns transformed into automobile-dominated sprawlburbs. The state cannot afford to subsidize drivers’ tolls, especially when taxpayers are asked to foot the bill.

Where to begin…

First, people don’t budget tolls on a per-mile basis. A $10 toll costs $10. Your chart conveniently ignores the long distances between exits on the Thruway, typically 10 miles or more. Not so in Chicago or northern Virgina!

Next, Upstate New York is NOT New York City. They are much less dense, much more rural, and much more subjected to sub-zero temperatures and heavy, lake-effect SNOW. So this toll assistance is not keeping anybody “sedentary” because no one in Upstate New York is walking or bicycling 50 miles a day on the Thruway to avoid driving. They also don’t have as reliable a bus service as NYC does, and they don’t even have a subway system where they wouldn’t be subjected to the weather.

Take my word for it: You do not want to be that person waiting an hour in sub-zero weather for a bus to arrive on an upstate New York route, if you have the choice to drive. Stop vilifying people who place their health and comfort at the top of their priority list.

Furthermore, hiking tolls on commercial trucks will not impact trucker companies and will not encourage them to use freight. On the contrary, they will simply pass along their expenses and charge us more for the same goods – as they already do.

Even if they didn’t, they would divert off the Thruway onto local roadways, to avoid the tolls outright. And then the local municipality would be stuck upgrading their roads.

And finally, with respect to weather, you need to acknowledge that even if we cut traffic volumes in half, we’d still need to repave our roads every few years. Why is this? Because Upstate New York has freeze-thaw cycles, heavy snow (which warrants plowing activity), high humidity summers, and extreme weather patterns. This has always been the case, regardless of whether the weather is more or less extreme today than in decades past.

Yes, NYC and Long Island send more money to Albany than we get back. But that’s a taxation issue; it’s not a transportation issue. If anything, we should be lobbying for the same tax credit assistance to drive across the Throgs Neck, Whitestone, Verrazano, and Goethals Bridges. We should not try to hurt our upstate neighbors in their pocketbooks.

[…] Citizens Budget Commission — The CBC called on New York lawmakers to reject a proposal giving Thruway drivers a tax credit on tolls. […]

[…] York State Assembly and Senate — Both the Assembly and Senate rejected a plan that would use limited transportation dollars to subsidize tolls for […]