Transit riders throughout the tri-state region are facing heavy financial burdens after the transit commuter benefit was rolled back on January 1.

Before the cut, Americans could spend up to $230 in pretax income on the public transit that gets them to work, but the figure is now $125. At the same time, an equivalent benefit for parking rose to $240 per month, which means that the federal tax code now incentivizes driving over public transportation.

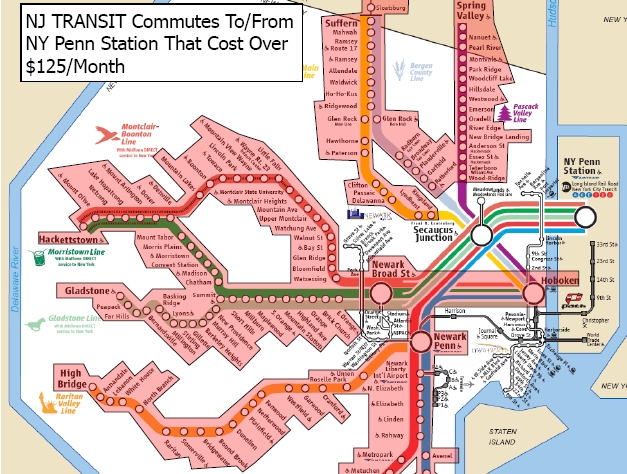

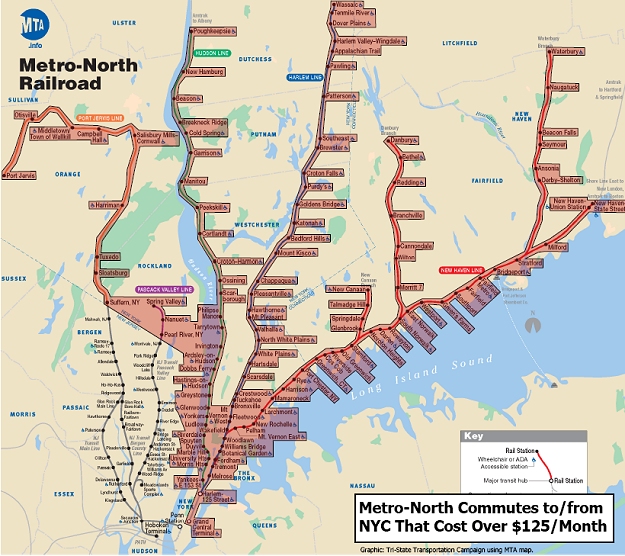

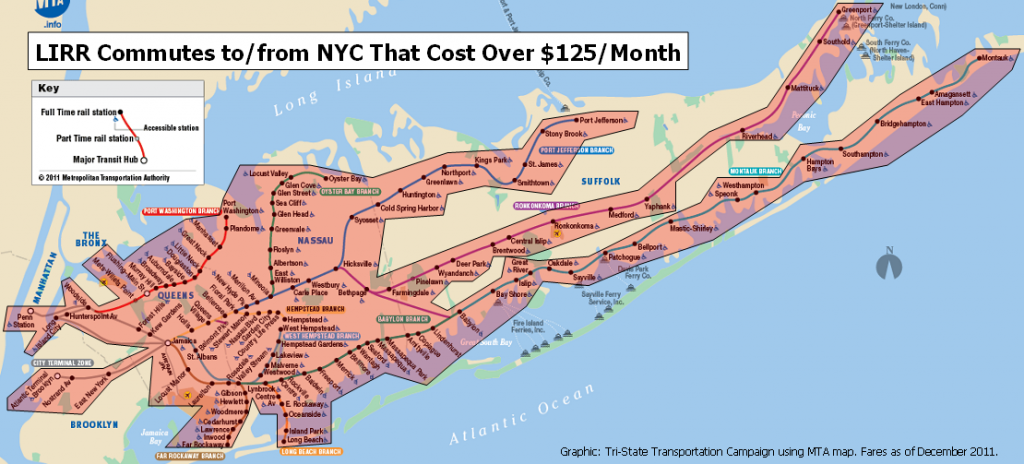

A monthly pass between New York City and almost any station on NJ Transit rail, Metro-North, or the Long Island Rail Road costs more than $125. For someone who makes $50,000 annually and spends $230 a month on transit, the rollback is tantamount to a yearly tax hike of $400.

Lawmakers that attempted to extend the expiring commuter tax benefit at the end of last year have renewed their efforts in 2012. Senator Chuck Schumer said he would continue working to restore the benefit, New Jersey Senators Frank Lautenberg and Bob Menendez made similar pledges, and Connecticut’s Senator Richard Blumenthal and Representative Rosa DeLauro highlighted the issue at a press conference. All support the Commuter Benefits Equity Act (S1034/HR2412), which would permanently set the transit benefit equal to the parking benefit at $240/month. It has been co-sponsored by 10 senators, including all six from the tri-state region. The House equivalent currently has 62 co-sponsors from both sides of the aisle.

When Congress debates the extension of a payroll tax cut, which will expire on February 29, legislators will likely have an opportunity to restore the benefit on a temporary basis. Commuters can e-mail Congress in support of restoring the transit benefit at CommuterBenefitsWorkForUs.com.

In the New York State Legislature, Senator Charles Fuschillo has introduced a bill to allow residents to deduct commuting costs from their state taxes as if the federal benefit had not been reduced. (State residents would still have a higher federal tax bill if Congress does not restore the benefit).

After the jump, TSTC maps show the rollback’s impact on Metro-North and Long Island Rail Road customers. NYC express bus riders, NJ Transit riders, commuter bus riders, and many whose commute involves multiple transit systems also have monthly transit costs that top $125.

Metro-North:

LIRR:

[…] How the Shrinking Transit Tax Benefit Costs Commuters in the NYC Region (MTR) […]

[…] How the Shrinking Transit Tax Benefit Costs Commuters in the NYC Region (MTR) […]

Please restore in full the tax benefit of paying for transportation in before tax dollars. Failure to do so impacts me greatly.

Thanks,

Walt

[…] version.” The New York Daily News urged the House to ensure transit funding and restore the transit commuter tax benefit, and the Connecticut Post similarly commended the commuter benefit restoration. From Chicago to […]

[…] January 1, transit commuters across the nation lost an important tax benefit. While drivers can deduct up to $240 in monthly commuting expenses from their pre-tax income, […]

[…] riders were eligible for the same $230 per month tax benefit as drivers. But because Congress failed to act, the transit commuter tax benefit plunged to $125 per month, while the tax break for parking rose […]

[…] riders were eligible for the same $230 per month tax benefit as drivers. But because Congress failed to act, the transit commuter tax benefit plunged to $125 per month, while the tax break for parking rose […]

[…] parking benefits were equal, but due to Congressional inaction, the transit benefit was cut at the start of the year.) The MTA has estimated that, for a worker in the 15% federal tax bracket, the transit benefit […]

[…] Congressman Earl Blumenauer of Oregon proposed the Commuter Relief Act in May 2011 to remedy these limitations. Although the bill didn’t pass last session, there is an opportunity now in the tax discussion to revisit, and improve, the bike tax benefit. Blumenauer’s bill would increase bike benefits from $20/month to $40/month, and allow bike commuters to combine the bike benefit with other commuter benefits, up to $200/month. This legislation also seeks to cap all commuter benefits at $200/month and allows self-employed individuals to be eligible to receive transit tax breaks. Lastly, the Commuter Relief Act would reduce the parking benefit from $240/month to $200/month and bump up the transit benefit from $125/month to $200/month. […]

[…] Congressman Earl Blumenauer of Oregon proposed the Commuter Relief Act in May 2011 to remedy these limitations. Although the bill didn’t pass last session, there is an opportunity now in the tax discussion to revisit, and improve, the bike tax benefit. Blumenauer’s bill would increase bike benefits from $20/month to $40/month, and allow bike commuters to combine the bike benefit with other commuter benefits, up to $200/month. This legislation also seeks to cap all commuter benefits at $200/month and allows self-employed individuals to be eligible to receive transit tax breaks. Lastly, the Commuter Relief Act would reduce the parking benefit from $240/month to $200/month and bump up the transit benefit from $125/month to $200/month. […]